In today’s news, the Securities Depository Center (SDC), a public institution responsible for maintaining the registration of securities ownership (such as stocks and bonds), is proposing a new law under which all dividends (profits made by a company) paid out by publicly listed companies are to be managed by the SDC itself, rather than by the companies directly.

The SDC’s director, Sarah Tarawneh, states that this move will increase both foreign and local investor confidence. On paper, the proposal looks basic, but I want to look at it from the point of view of the average Mo, using my scientific scale of the Good, Bad, & Ugly. (The reader may notice that what is good for the retail investor often turns out to be bad for the SDC or the government—as if the scale is diametrically opposed.)

Full article: https://petra.gov.jo/Include/InnerPage.jsp?ID=313920&lang=ar&name=news&cat=news

Audi alteram partem

(let the other side be heard as well)

The Good

An average investor that owns shares in different companies usually has a lot of work to do to collect their dividends, such as following up with each company (collecting cheques in person, contacting the investor relations department to update banking details, etc.). If the SDC goes ahead with their plan, this would streamline the process for the investor, who would only have to deal with one party, saving them a lot of time. (This could be bad for the SDC/government, as they might need to hire a significant number of seasonal workers during earnings season to handle investor requests, emails, phone calls, and other logistical demands.)

An average investor often forgets (even in the digital age) what shares they own. In some cases, the investor (or their heirs, if the investor passes away) leave dividends unclaimed. After 15 years, if these dividends remain unclaimed, the money is transferred to the Treasury. Reclaiming those funds can be a bureaucratic nightmare, requiring numerous official documents to prove inheritance, for example. Having the SDC as a centralised institution to handle such cases could make the process easier. (Bad for the government: less unclaimed money would end up in the Treasury.)

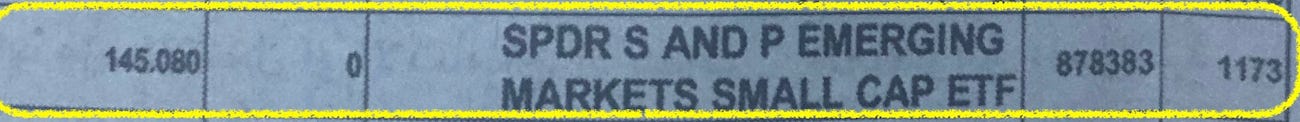

An example of a U.S. fund properly performing its due diligence and fulfilling its fiduciary duty: it forgot ~$200 in unpaid dividends from Jordan Petroleum Refinery from 2008.

The Bad

Dividends have to be paid out within 45 days after a company’s general assembly meeting. Should the SDC become the facilitator, it will obviously require companies to transfer that sum as soon as possible, since the SDC will have significant operational work to handle in order to redistribute those dividends on time. This means companies end up with less flexibility in their cash flow management.

In this case, however, the move could benefit the government or SDC. As a CFA analyst smartly pointed out, the sum transferred on day 0 to 15 can still be paid out on day 45—leaving that money sitting in a bank account for up to 30 days, quietly earning interest for the SDC (which is a non-profit entity and transfers its surplus funds to the Treasury). In 2025, ASE-listed companies paid out 1,263,538,888 JODs in dividends. At the CBJ’s 6.5% main rate, the SDC could earn around 6 million JOD in interest. (The SDC already covers its operating costs, so this would be 6 million extra for the Treasury.)

& the Ugly

To the paranoid conspiracy theorist, this move can be seen as a way to centralise control over shareholder payouts and essentially hold dividends hostage. The SDC could act as the government’s agent and withhold tax on dividend payments if capital gains taxes are increased from current levels. This would be great for the Treasury, as it means more upfront cash flow. The investor can only claim a tax refund when (and if) the government decides to process it at some undefined point in the future.

To the digital paranoid (such as myself), always fearing the digital apocalypse, digitally stored records of securities and dividends are inherently vulnerable to hacking by malicious actors. Any institution has been, is, and always will be at risk of a cyber breach. It’s always wise to keep a physical, official copy of your records of share ownership, just in case.

Conclusion

All in all, the good outweighs the bad (depending, of course, on how responsibly the government acts). As a former JSC Commissioner and ASE Board Member pointed out (he also writes on Substack): “[t]he SDC has an important role to play in the securities market. Distributing dividends will actually safeguard the financial rights of citizens. Later on, the SDC should be corporati[s]ed and even listed on the stock market.”

If things move in that direction, the horizon looks more promising.

In other news today: