Eschatology (noun) branch of theology concerned with death and the afterlife.

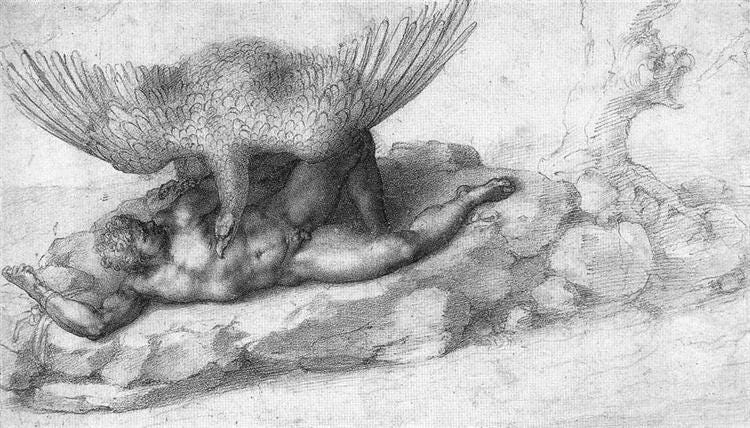

A famous headline broke out during covid: Brooks Brothers, founded in 1818, filed for bankruptcy in July of 20201. 2 months later, in September, it had a new buyer and just like a phoenix, it rose from the ashes.

In Jordan, CJC, founded in 1949, shut down its factories and stores just before COVID and until today no one knows what is going on.

So what happens to Jordanian companies when they “die”?

Before jumping into the details of the corporate death of Clothing Company CJC, let’s briefly look at the basics of corporate forensic pathology:

Simple Thanatology

Thanatology (noun) science of death

In every medical report, you would see a cause of death: in finance, the usual suspects are either Liquidity or Solvency. In very simple terms, Liquidity is when you cannot meet short term liabilities (Assets in balance sheet cannot convert to cash fast enough with declining revenues and rising costs). Solvency is when you cannot meet long term liabilities (Liabilities > Assets in balance sheet).

We hear people loosely use legal jargon “bankrupt”, “insolvent”, or “administration” (افلاس/اعسار) but I’ll only use bankrupt here.

When the company’s management know they face certain death, the usually file for “Chapter 112” or “Chapter 7” (for basic “limited liability company structures”).

In Jordan these laws are:

-for chapter 7, we have (voluntary or involuntary) liquidation proceedings تصفية)3) - A liquidator/administrator is appointed. At the end the company shuts down after selling all its assets to pay off its liabilities as much as it can (and is investigated for any wrong doings).

-for chapter 11, we have insolvency proceedings/bankruptcy protection (قانون الاعسار رقم (21) لسنه 2018)4

Bankruptcy protection: basically it protects the company from its creditors when it files an application in court. Banks, bondholders, or suppliers won’t be able to act in a predatory fashion against the company by seizing assets of the company: for e.g. freezing bank accounts or property (land, automobiles, buildings, machinery, inventory, etc.); assets that are vital for the daily operation of the company are protected for the debtor and creditor.

In this process, the company continues to operate on a daily basis without fear. However it has to go through a restructuring/recovery phase. New management would need to come up with a plan on how it plans to cut costs/losses while increasing cash/revenue (operational cash flow), reduce liabilities (balance sheet) . Usually the first step is negotiations with creditors: longer term payments or take a hair cut. Second step would be to sell any assets (Al Rai sold off its headquarters to its biggest creditor the Social Security Corp.)5

Brief History

Founded on the 28th of May 1949 and went on the 15th of January 2006 it went public. At its height in 2008 it had 162 employees, 16 stores across the Kingdom and 4 million JODs in sales and in equity. Since then, everything went downhill.

Sales performance:

By 2016, CJC’s losses wiped what was remaining of its equity. The company was technically dead, and until today it is a walking zombie seeking salvation.

For a good coverage, check out 7iber’s article from 20206.

Timeline to Death

“Where do I begin?” Shirley Bassey

This reads like a crime detective novel that is both fascinating and depressing at the same time (I recommend checking out all the disclosures from 2016-2022)

3.10.2016: disclosure by CEO on the share price increase being subject to market supply/demand, unrelated to any internal decisions. Share price has dropped 30% from 0.44 JODs a share a month prior. 1st clue

13.10.2016: Engineer Association (who owned >50% of the company) sell remaining share holdings in CJC (and board representatives resign right after). 2nd clue

1.12.2016: Minister of Industry and Commerce appoints an Interim Management Committee to take over the company. 3rd clue

18.01.2017: CEO disclosure that a restructuring process is ongoing with negotiations between board of shareholders, board of management, and employees, and creditors

This is when CJC, that was just on the edge, fell in the black hole of never ending problems. By stating that “there is nothing to worry about”, everyone got spooked.

2017-2018: Operations seize. All employees are let go. Factory building and other assets seized by creditors (temporary). CJC management tries to negotiate to release said assets but to no avail. Company faces heart seizure.

11.12.2019: Board at CJC officially files for bankruptcy protection using the Law N 21 of 2018. Just bad timing for CJC to have the law come out in 2018, 2 years too late.

02.03.2020: Newly appointed board to take over and fix the situation.

14.06.2020: During the pandemic, the court drops the application for bankruptcy protection (you can’t file for it if you are already in trouble). And during this time, CJC sues traders using the CJC trademark illegally and selling counterfeit goods. CJC still stuck in corporate limbo.

31.03.2022: Court of First Instance for Tax Penalty acquits CJC of tax evasion offences. (only good news I could find)

3.9.2022: Company loses court case against previous managers at the first instance but appeals.

Captain Wael Abdallat is now at the helm of the company, doing his best to launch the brand once again. I sincerely hope he manages to pull a “Lazarus” miracle and revive it once again. Maybe it could do what Zay couldn’t.

In the End

In Jordan, it’s literally hell for bankrupt companies. It’s a junkyard where the owners and management immediately flee the scene knowing there is no hope of a recovery. If bankruptcy is hell for companies, it’s heaven for the vultures, i.e. the lawyers and administrators, who prey on these dead corpses. Just take a look at the big companies that went bust in the 90s. The insolvency managers still sit at the helm collecting fees, DECADES LATER, instead of liquidating it and winding it down within the legal time limit.

In Jordan, companies should be able to die with dignity or at least mend their affairs without the fear of predatory banks and government institutions constantly harassing them. It is only when companies stop living in fear & misery, with fair and swift justice, can they start to thrive & prosper.