So you either recently watched the movie Limitless on Netflix

Or you watched at how millions of average Americans invested their stimulus checks on the stock market and made crazy returns through Robinhood ($HOOD) on meme stocks1 or cryptocurrency and NFTs.

Now you feel like you are missing out (FOMO)

If you are one of the lucky few who have a bit of savings set aside and are worried about future inflation and do not want your money to sit in a savings deposit at a bank for a boring annual rate of 3.5%, here are some quick tips on how to invest in the Amman Stock Exchange. This is very basic:

Pick a Strategy First!

There are 3 types of investors in the stock market and they all depend on various factors: amount to invest in, duration of investment, whether long term or short term, risk appetite etc… .

Very important to note that owning stock means that you own a share of a company making you a shareholder. Unlike what most retail investors think it is, this is not a casino for gambling.2 This is a market place to exchange stocks (shares in companies) for cash.

1. Passive Investing

This strategy is either for the faint hearted or those with a long term strategy (>1 year). Passive investing means you buy shares and forget all about them. All you have to do is wait for the annual general assembly meeting of the company you bought shares in and see how much dividends they will be distributing. Dividends are the (after tax) profits that will be distributed to the shareholders. Dividends are tax free in Jordan!

For example on the 23rd of April of this year, Jordan Islamic Bank (ticker: JOIB) distributed 24 million JODs to its shareholders from profits made in FY 2020.

The passive investor doesn’t care much for the stock price movements, despite that the same bank made a return of 11% (ex-dividend) year to date:

2. Active Investing

Active investors are the ones who ride the waves of stock fluctuations. They are the scalpers seeking profit when buying low and selling high. The time frame varies but it goes from >1 day and generally <1 year. In the Amman Stock Exchange, there is no place for day trading. Despite removing the cap on 5% price movements on stock prices, the bid/ask system is set on the opening bell with the previous closing price.

Let’s go back to JOIB.

Yesterday’s closing price (i.e. the last transaction made during trading hours) was 3.44 JOD/share. Today’s opening price was 3.42 (i.e. first transaction made during trading hours), meaning the stock was already down -0.5%.

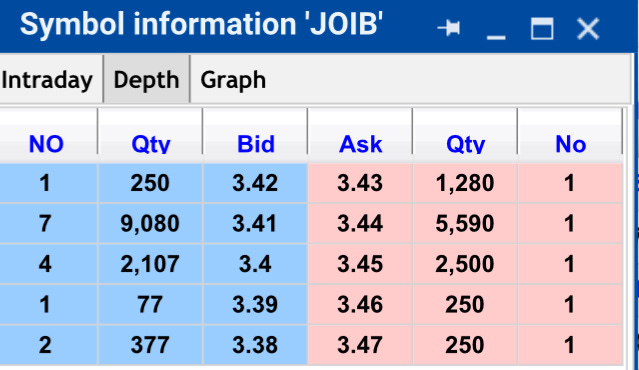

As an investor who wants to buy shares of JOIB, you are only limited to buying what is on the right side of the below table, the ASK column (asking price and quantities of JOIB shareholders willing to sell their shares). Or you could place a BID, telling the market how much you are willing to pay for a share.

Like any market, its main fundamental is supply and demand. If more people are willing to sell (current shareholders who want to liquidate their positions) and are not patient enough to wait for a buyer to meet their ASKing price, they would “dump” their shares to the next BID. Hence the price would go lower than the opening price of 3.42 JOD. As a buyer or seller, you cannot place a price at might higher or lower prices than seen on the table. Also the BID/ASK spread doesn’t fluctuate with the last price. It stays fixed for the whole daily session. Therefore day traders cannot make profit from daily fluctuations, but have to wait a couple of days or weeks or months to see a return on their investments. Another key aspect in day trading: there is no SHORT SELLING in ASE. You cannot profit from a stock if its price falls. I personally belong to the camp that does not want to introduce short selling in the ASE as this could make more harm than good to investors (especially the Social Security Corporation).

3.Activist Investing

This type of investment, especially in Jordan, is for the most courageous of investors or the craziest of them all. This strategy is sometimes reserved for the wildest of investors.

Basically it means that the investor would buy not a just a handful of shares, but a big chunk of a company. The investor then gets a seat at the board of targeted company. The investor maybe has a strategy that could help grow the company or guide it to a certain direction.

In Jordan, most companies listed on the stock exchange are traditionally family owned and heavily guarded. The biggest Activist/Passive investor is the Social Security Investment Fund (our pension fund) with around 2 billion JODs invested in equities.

Next Steps

N.B. All information below can be found in the the Amman Stock Exchange website.

After deciding on your strategy, you will need to do the following:

1.Find a broker

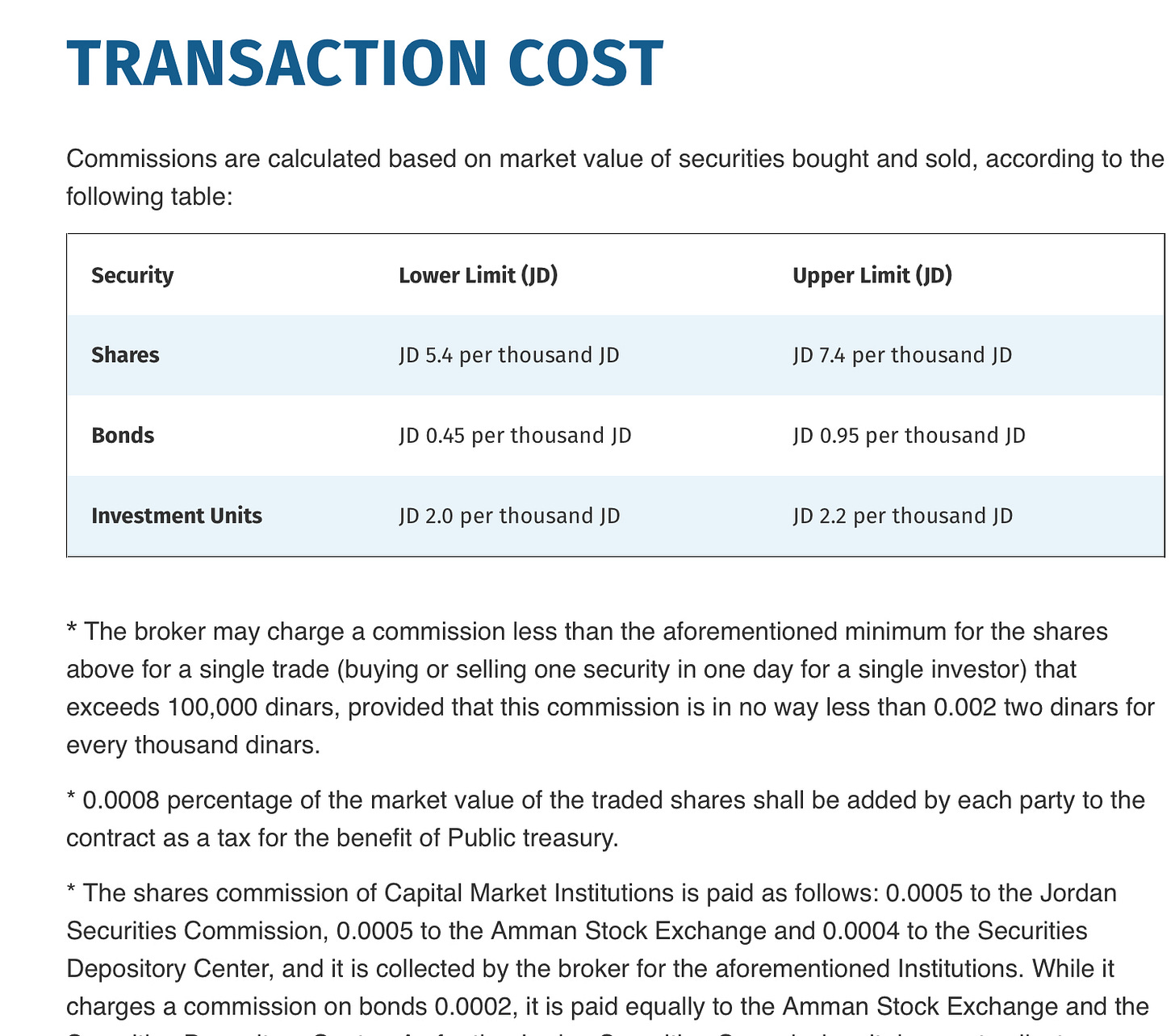

This is the person/company trading on your behalf. They will take a fee of course. Don’t forget that the ASE and SSC also take a fee. All these need to be taken into account.

Look for the broker with the best reputation and maybe see if they have an app instead of calling them up every time you want to trade.

List of brokers can be found here.

2. Open a Live Market account

Use the link here to create a free account to see daily market prices and liquidity in the markets. Link can be found here (also app is available): AseLive.jo

3.Research

This could be the most or least fun for any investor.

Information is key to any investor and they should always make smart calculated and well researched decision to any investment. Thankfully transparency is one of the fundamentals of the Amman Stock Exchange, and those that break the rules get punished.

-Read the Financial Statements (quarterly and annually) and any other disclosure the company makes. This could be key. For e.g. you could see a trading disclosure where the spouse of the chairman of the company sold all her shares. Maybe that person knows something?

-Find out who the management and main shareholders are in the company.

-Follow up on news of the company or related company in the same market/sector. Sometimes you could listen to what the street is saying (“buy the rumour sell the news”).

-Read market news and subscribe to financial newsletters. Al-Mawared brokerage for example has a weekly market catch up here. Diversify your news sources like you would your investments.

-Do your own maths: with all financial data available, you can make your own calculations. Most look at Price/Earnings ratio, Price/Sales ratio, Sales Growth numbers, Book value, Dividend Yield etc.

Best place to look at those is in the Monthly Bulletin here.

There is of course a lot of things to cover even at a basic financial level (definition of volatility and other financial tools to calculate returns, differences in sectors in the ASE and weighted diversification strategies, differences in markets and the OTC market…) but I hope this gives novice investors a taste of what to expect in the stock market. Of course don’t gamble all your life savings and never forget to diversify (“don’t put all your eggs in one basket”)

Happy investing!

“Carpe Per Diem” (Seize the money)

Robin Williams

https://www.investopedia.com/meme-stock-5206762

https://www.cnbc.com/2020/05/22/gamblers-pivot-to-stock-trading-during-lockdowns---barstools-portnoy-revives-old-e-trade-account.html