“For the world is changing”

Treebeard

The reader doesn’t need a recap on where we are right now, but let us get the basic facts straight without going into too much detail:

-US State Department (their Ministry of Foreign Affairs) paused international aid for 90 days across the globe. USAID projects in Jordan affected.

-US President Donald Trump proposed that Jordan and Egypt will take on refugees from Gaza (even though both Arab countries openly rejected the plan).

Now everyone is worried about Jordan’s economy and the pressure the US could place to force us to accept this plan. Moreover, the worry lies in the future of the Jordanian Dinar and its peg to US dollar.

To appease fears, I will try to tackle this question in a “rationalist”1 manner and briefly assess possible scenarios, outcomes, and what action plans are needed. I hope the government and business leaders are being proactive and devising war games and strategies for these scenarios, because unfortunately for what we have seen for the past decades, Jordanian policies have always been late to address the problem and re-active to exogenous shocks.

How dollari$ed is our economy? (apart from the JOD/$ peg)

Trade:

US President Donald Trump is imposing tariffs left right and centre. NAFTA (🇨🇦🇲🇽) got hit first so I won’t be surprised if other countries with FTA’s (and a trade surplus against the US) would be next.

Jordan has had a Free Trade Agreement with the United States of America for the last 24 years. Jordan mainly exports one commodity to the US: apparel, valued at 1.5 billion JODs from January 2024 until November 2024, which constitutes 19% of Jordan’s total domestic exports (or 4.5 billion according to Jordan Strategy Forum’s new monochromatic dashboard).

We also import most of our fuel from Saudi Arabia (another country with a $ pegged currency).

Trade Balance:

Exports ~8 billion JODs - Imports ~17 billion JODs = -9 billion JODs deficit

Current Account Balance: -2.5 billion JODs (after factoring in net tourism receipts, net expat remittances etc.)

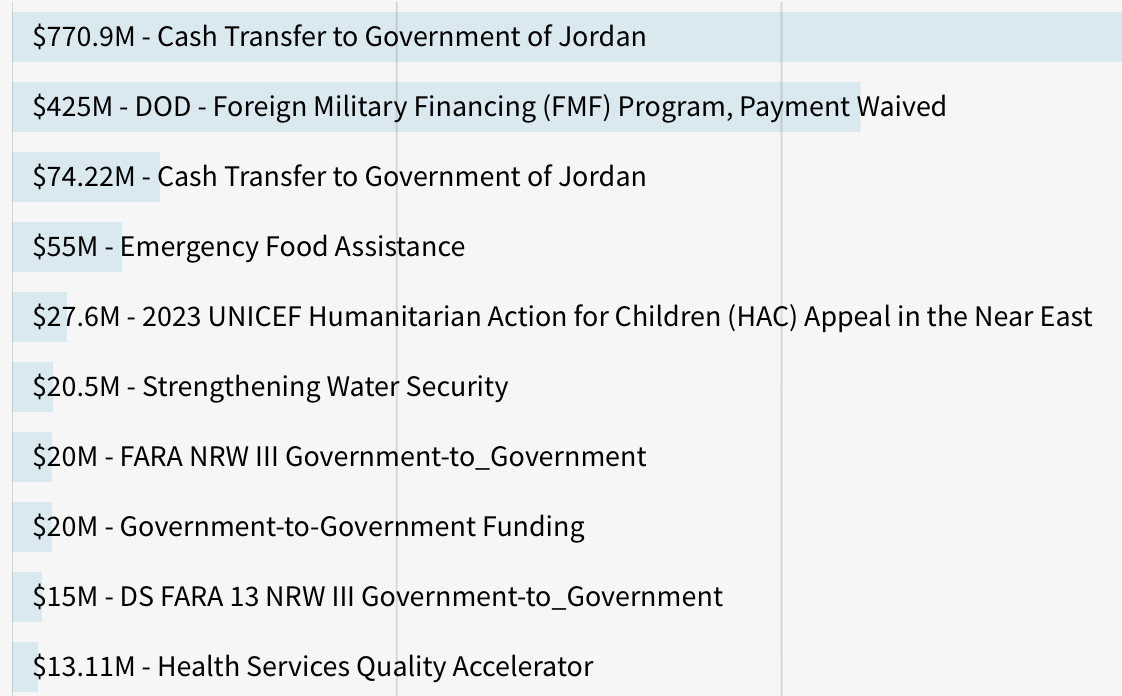

Aid: Jordan received around ~$850 million JODs in budgetary support (8% of budget revenue) + $425 million JODs in military equipment. The rest are essential humanitarian projects employing many and benefitting even more Jordanians. Including US budgetary aid, the government budget deficit is expected to be 2.2 billion JODs in 2025.

Debt: Jordan’s total debt is 46 billion JODs

External debt2 in $: ~20 billion JODs3 of which 7 billion in bonds. The next Eurobond (in $) to mature is this July ($500 million, ISIN XS2199321113)

Repercussions snapshot

Assumption: There are 2 “depeg” scenarios: a complete free float or a managed float. I will assume for now that we will go the path of controlled depeg where the new rate exchange will be at par with the $, i.e. 1 JOD = 1 USD (that’s a devaluation of around 30% of the Jordanian Dinar. The reason I picked this range is because this rate should be the optimal rate to balance ⚖️ our current account balance of - 2.5 billion JODs. What we want to avoid is a devaluation similar to that of Turkey, Venezuela, or Lebanon).

“It is the little conveniences that make the real comfort of life”

Mark Twain

Trade: In terms of trade, it will become more expensive for us to import. Exports will benefit if most of our raw material is locally sourced (potash, phosphate). Possible boost in the services sector.

FTA tariffs: The textile industry will be the first hit. It employs around 77,000 workers 75% of which are foreigners.4

Foreign Workers: There are around 300,000 registered foreign workers in Jordan. A devalued JOD could mean a less attractive prospect to come and work here. Could this boost local employment??

Inflation: higher cost of imported goods will mean higher inflation. At 30% devaluation, energy (mainly heating bill) alone will contribute to an uptick of 1.5% inflation (current inflation rate is 2%). Of course this will reverberate and contaminate the whole supply chain as energy powers each step.

Transportation: As above, higher fuel costs will mean a more expensive transport bill.

Government revenue: In terms of sales tax on products, government revenues could remain stable or increase as it is a fixed % on price. If for example the price of 95 benzene goes up by 30% to 1.4 JODs/Litre and demand drops 30%, government tax on it will drop only 9%.

Government expenditure: assuming salaries remain the same, the biggest increase will come in servicing the $ debt. Cost saving measures will be sorely needed at this point (corruption leakage), maybe even cutting back on more subsidies.

Government rating and debt: we need to ensure the rating remains fixed and impress the agencies on the quick recovery process. A downgrade will start a negative feedback loop that will increase the cost of borrowing even more which will increase the risk of default etc.

Tourism: One complaint that most local and foreign tourists have is that Jordan is too expensive compared to other famous hotspots (like Turkey, Egypt, Thailand). We could see an uptick in tourism in this new scenario.

Monetary policy: breaking free of the Federal reserve; freedom to reset Central Bank main rate at a new level (lower if inflation is maintained) and new regime of narrowing spreads.

Stock Market: Countries that saw their currencies devalue also witnessed increase in stock market prices.5

FDI: A devalued currency could be more attractive to foreign investors. It is true that the JOD/$ peg was a pillar of stability and confidence to investors, but we need to move on.

Real Estate: Same as above.

Food: A lot of our food is imported. An increase in food prices will mean lower caloric intake (stock up on caviar now if worried). But we could learn something from Cuba 🇨🇺 after the collapse of the Soviet Union. The Caribbean country had one of the highest tractor/capita ratio in the world and was heavily reliant on Soviet oil imports. After the collapse of the USSR, Cubans started to rely on themselves to grow their own food. Every empty plot of land nearby near residential buildings started to get cultivated. Unfortunately Jordan’s biggest weakness is its water resource6, something we cannot easily get by import except via prayer 🤲.

Reserves: CBJ’s gold reserves value will increase in JOD terms of course. But I want to talk about people’s personal reserves (which should remain a secret) 🧿 Most of the boomer generation in this country has lived through war, crises, and penury. They have gotten used to the instability. They believed in stocking up in food & hard assets and still do. This is something that will be crucial in absorbing the biggest shock of the devaluation in the short and medium term.

Policy recommendations (study not funded by USAID)

“The best laid schemes o' mice an' men / Gang aft a-gley.”

Robert burns

My first recommendation for the government is to let the market regulate itself. All it has to do is maintain order, ensure no one is above the law, and enforce regulations on price gauging. We have all seen how panic ensues in the region after a (currency) regime change. Jordan has been considered the Switzerland of the Middle East, with safety and security (امن وامان) a key component of stability to the country. We need to avoid a panic. The country should remain united in order to take the initial hit. When it comes to bank runs, one thing that can be done is placing strict capital controls as our neighbour Cyprus did during the Euro crisis. Also it is best to avoid sending out tax collectors out of desperation. The government should be ready.7

My second recommendation is to find way to help alleviate the burden of higher inflation to those most affected. For example, the government can force their own employees to carpool, hybrid work model, encourage the use of public transportation (by launching a monthly ticket at reduced prices).

My third recommendation for the private sector is to learn to adapt. Maybe read Who Moved My Cheese? 🧀. A business should pivot or innovate. For e.g. not all factories in Sahab should have their own delivery truck to distribute goods to every shop in the country (the key is reducing cost by consolidating efforts). And with the increased cost of oil, maybe packaging in plastic containers should be reconsidered.

My fourth recommendation is for the country to probably find new friends. A friend in need as they say.

[Apparently Saudi is to invest $600 billion in the USA. With only $20 billion, Gaza can be rebuilt with a brand new Saudi-owned waterfront promenade project. The rest can be used to alleviate poverty and hunger across the world including Arab and Muslim countries. They don’t have to be donations. They could be investments. And they could leave $100 billion for research and development?]

Personal take (from a non-political analyst)

This is not the first time the Jordanian Dinar is taking a hit for the Palestinian cause8. In 1988, the JOD rate was trading at around 30 piasters per $. After the disengagement decision (and this is a very short summary of events), many West Bankers holding Jordanian passports were worried they wouldn’t be able to gain access to their accounts in Jordan so, out of fear, they pulled out their monies then converted them to $. This pressured the JOD exchange rate forcing the CBJ to sell its gold reserves. It was a severe hit to the economy with many businesses and banks going bust (most famously Petra bank).

Of course a repeat of this scenario is something every one is worried about and wants to avoid.

But this time could be different, even though we have become a bit more spoiled as a generation. Maybe this scenario could be beneficial to us, a blessing in disguise of some sorts to solve our chronic issues.

One thing we could see post-devaluation is cutting back on our oil dependance. As an environmentalist, I think the depeg regime could be healthy for us. We no longer need a car to buy groceries; we can go on foot or by bike. The plastic bag will no longer be Jordan’s national flower as it will become too expensive to throw away. No more driving around aimlessly and throwing cigarettes and coffee cups out of the car window.

We could stop seeing things like this 👇

From a foreign policy perspective, I think we should look at the other side of the equation. A first lesson in the art of the deal is to always negotiate from a strong position and to know the enemy’s weakness. Unlike a standard poker game, in this scenario, all the cards are visible. No one is bluffing9

Post-Ukraine and Gaza, the US has seen its armoury and weapons stockpile deplete extremely fast10. Last year, US President Biden’s administration has hit the Houthis with 25 Tomahawk missiles in 1 day (at $2 million a piece) and they repurchased much less. The US is trailing behind China’s rapid navy build-up11 by outsourcing to Japan and South Korea.

Jordan is a NATO ally (and an integral part of the military training of our neighbours).

And Jordan and the US have been close friends for a very long time. They have even entrusted us with babysitting Israel for the last 30 years.

However the US is slowly losing many of its close friends and allies and could be left facing its enemies on its own.

If the US really wants to twist our arm, it will be just disappointing to break off such a long and deep friendship. The US just has to wake up to the fact that the orange emperor is wearing no clothes12 and that their baby is helpless.

Let’s not brood longer on this subject. All I say to those who want to put pressure: bring it on.

The term ‘rational’ derives from latin ratio meaning to divide. In this sense, a rationalist divides the future in all possible/logical outcomes. But as we all know, there is always only one outcome and that is “the best of all possible worlds” (Leibniz).

Page 8 for detailed breakdown : https://mof.gov.jo/ebv4.0/root_storage/ar/eb_list_page/public_debt_quarterly_report_-q3_2024_.pdf

Let’s see if this certificate is worth something: https://jordantimes.com/news/business/income-department-earns-iso-certification-business-continuity-management

Stupid question: can assets (including financial and monetary) achieve martyrdom?

From the last episode:

Video: