Ozempic, originally intended as a medication for treating diabetes, is now considered a wonder drug helping millions of obese people around the world lose weight. Its manufacturer, Novo Nordisk, is a Danish 🇩🇰 drug maker listed in Copenhagen’s stock exchange. Its market cap is around $480 billion while Denmark’s GDP is $400 billion. Now imagine if on Ozempic’s website, you find instructions on how to lose weight naturally, through non-sponsored healthy diet and exercise, instead of trying the drug. In an ultra-capitalist sector such as pharmaceuticals, this could never happen.

Except in Jordan 🇯🇴. Baby formula maker Nutridar actually encourages breast milk as the best source of nutrition! It is so rare and refreshing to find such genuine and cool corporate philosophies.

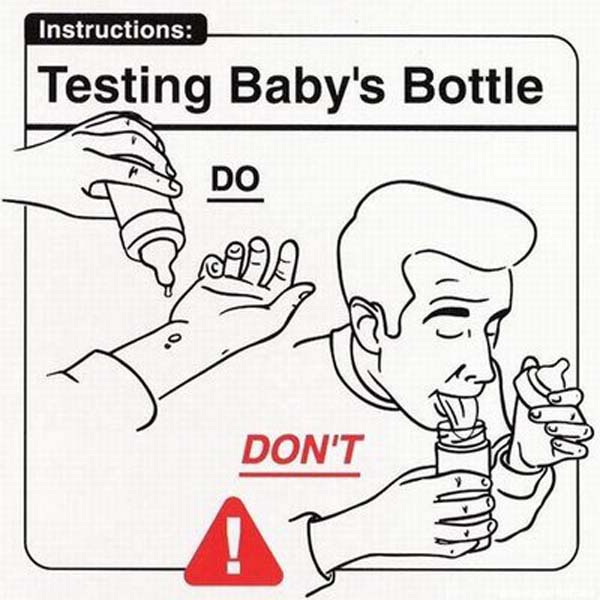

Let’s look at the financials of the company and see if they offer any other good advice (unlike this one 👇)

Nutridar (NDAR.ASE), listed since 1998, manufactures infant formula and baby foods. It currently employs 114 Jordanians (20% female only).

In 2023, it generated 13 million JODs in revenue. It has grown 13 fold since 2000. It has a market cap of 9 million JODs and a P/E ratio of 95. 50% of its sales are exports.

“A sibling is a friend given by nature” Jean Baptiste Legouve

Nutridar is 90% owned by Dar al Dawa (or DADI.ASE, in turn 19% owned by SSIF) and 2% by the Jardaneh family (of Investbank). This ownership structure reminds me of chip manufacturer ARM 0.00%↑ where Softbank owns 88% (leaving so little supply of shares on purpose to prop up the price 🚀). Despite this, the stock is still underperforming due to very low profit margins. In fact, out of the all food manufacturers in the F&B sector in the market, Nutridar hasn’t paid out any dividends back to shareholders. That makes it one of the 103 stocks (out of 162) with a 0% Dividend yield.

For the past 5 years, revenue growth has also been lacklustre. It hasn’t yet reached its pre-COVID levels despite 11% growth in sales in 2023. Even pharmaceutical giant Abbott Labs ABT 0.00%↑ , who had to recall its Similac baby formula during the shortage, witnessed a better rebound.

Looking at baby stats: there have been on average 190,000 babies born per year since 2017, with a baby “boom” in 2021 (I guess due to COVID lockdowns)

It is interesting to note that the birth rate has been falling for the last 2 decades. In 2000, when the population of Jordan was 4.85 million, the birth rate was 26 per 1000. In 2022, it was 16 per 1000 (compared to 🇺🇸’s 12, 🇪🇺’s 10). I guess parents are opting for quality instead of quantity !? And this is the average birth rate: I know of a father with 48 kids that started his own ceramic empire (kids are nature’s free employees… when they reach the right age of course). So how come birth rates are declining? I mean maternity leave days have increased considerably in the last decades with good financial support from social security.

Does falling birthrates affect NDAR? Doing some basic maths, assuming all newborns would exclusively use baby formula during their first year (consuming 60 tins of 400g per year), Nutridar’s total market would reach only 34 million JODs locally.

So what explains its low profit margin? Well for one Nutridar’s formula is one of the most affordable in the market (and healthiest as it used by most neonatal hospitals). Keeping a low price has been a key strategy for management. Another aspect is the increasing cost of imported ingredients that has been eating up most of the profit margin.

If I were CEO1

-To increase sales, NDAR needs to increase exports. We keep hearing that Africa is the future and Aqaba is its gateway. And just like the EU rules of origin, very few companies dare to broaden their horizons and take a step outside. NDAR could also take advantage of the FTA with USA2 making sure their products are FDA approved.

Your children are not your children. Gibran

-Arabs (were cursed to) feel more deeply than others3. That is why any image of dying children, coming from Palestine, Syria, Iraq, Yemen, or even Sudan is … indescribable and that scar us deeply and will haunt us for a very long time. Are we that castrated in front of all the evil affecting us? What have we done to deserve this?

Every child deserves a chance at life, and I’m sure every parent knows how many sleepless nights it takes to raise and take care of one child.

I think the CEO of NDAR needs to work with other local manufacturers (Baby Life, Fine, HiGeen etc.) and start a fund raising campaign to send infant formula and baby supplies to Gaza asap. And to appease local hard liners, divert some of it to local Jordanians who need it.

In the meantime, if any reader is interested in donating, here are some links to some charities:

-Tikyet Um Ali donations for Eid

-Jordan Hashemite Charity Organization

And the one we always see on social media:

-GoFundMe page for Watermelon 🍉 Relief

Angels vs Demons

In this current climate debate where some claim our planet is overcrowded while others claim our resources are simply mismanaged, I personally and humbly believe that there is an overpopulation of devils on this Earth and that our sole duty is to bring in more angels to this world.

Also NDAR as a stock has a lot more upside.

Happy investing (and donating)!

“If I were CEO” is a segment inspired by this Harvard Business Review article - first used here:

El Zay Ready Wear

Hello readers! For publicly listed companies on the Amman Stock Exchange, I decided to change the style a little bit. These “equity research report” style newsletters will be divided into 3 sections: overview of the company, rating of their financials, and a “If I were CEO”

Jordanians always end up finding success 💰 in the US of A (whether they got there legally or illegally), like the recent example of Dr. Omar Hatamleh as chief AI exec. at NASA.

ما أطيبَ العيش لو أنّ الفتى حجرٌ

تنبو الحوادث عنه وهو ملمومُ

تميم بن مقبل