We come to the last part of the Venture Capital newsletter and as we have shown, there are many startups in Jordan with a lot of potential. But there are also startups that question the fundamentals of mathematics, finance, logic and common sense.

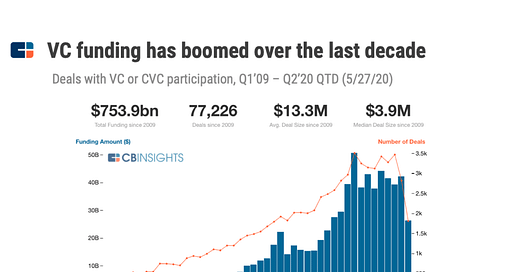

As stated in part 1, Venture Capital is turning into a cult. Since the Great Financial Crisis of 2008, Central Banks around developed markets have lowered interest rates to near 0 (or even negative) which in turn encouraged speculative betting in equities as bonds yielded next to nothing. Investors were hungry for returns and found it in the strangest of places, leading the way to mini bubbles as they rushed into a variety of themed assets starting with biotech stocks, cloud, 3D printing, AI, mobile applications, cannabis stocks and ending blockchain and cryptocurrency and fintech.

A famous example of this would be Kodak that created its own cryptocurrency when it was trending then pivoted to drugs after that failed.1

Same can be said for Jordanian startups: A startup simply needs to follow the latest hype and trends just to stay relevant. They don’t have to be solvent, just trendy.

This culminated into what can only be described as a bubble: Investors rush in to a company simply for adding “Blockchain” to its name (remember Long Island Ice Tea2) without even using said technology. Investors would even rush into buying the company’s own junk bonds keeping them afloat: a new abomination creeped up in the financial world, trendy cash-flow negative zombie companies. Another good example would be Nikola: an electric truck company that was recently charged with fraud and produces 0 electric trucks and yet has a market cap of $4 billion as of 3/8/21 (ticket: $NKLA) just because it is trendy to be in the Green Automotive sector and that the company has a dream.

Before digressing into the world of financial markets and equities, I want to place most of the blame mainly on one company: Masayoshi Son’s SoftBank. SoftBank managed to attract investment from the largest sovereign wealth funds (and other suckers) to invest heavily into its tech portfolio.

Most of the recently IPOd companies are not making any profits

During the pandemic, the fund has taken heavy losses

But the trend has not stopped. In 2021, lots of VCs are exiting via SPACs with two recent ones for the Middle Eastern Region (Anghami and SWVL). If you would like to understand the why SWVL was valued at $1.5 billion when it barely made 2 million in actual revenue, check out this thread:

This brings us to the last company in the newsletter:

There is something wrong about Mawdoo3

The Good

Mawdoo3 followed on the footsteps of its successful predecessor Maktoob by Arabising content on the internet. It decided to tackle the hardest part of that as well: Artificial Intelligence and natural language processing with the launch of Salma3

Mawdoo3 also launched its own fund investing in various startups in Jordan and the region. It is also acquiring various companies4 contributing to the M&A activity5 in the region. It is and can be considered one of the largest job creators in the country.

It also had the noble goal of creating the main platform for education and distance learning for the country (at no cost apparently) during the pandemic.6

The Bad

First, Mawdoo3 started as a competitor to Wikipedia. I think the basis of a company to compete with a non-profit is absolutely ridiculous. Mawdoo3 hires Arabic content writers. Wikipedia is a free online encyclopaedia maintained by a community of volunteers. Mawdoo3 is profit seeking and its content might be tainted by sponsors and advertisers (maybe, but this is a known risk amongst publishers and content providers).

Second, Mawdoo3 seems to have found out that it does not make sense to compete with Wikipedia which also has an Arabic version so it started to follow up on trends. It created Salma, an AI assistant that understands Arabic and its various dialects. Problem: ever since the first presentation of the product, nothing much has come about. Did Mawdoo3 simply enter into this field because it was trendy or do they really have the skills to tackle this problem? If they do, selling this technology to the likes of Google or Apple (Siri) or Amazon (Alexa) would be their Jackpot.

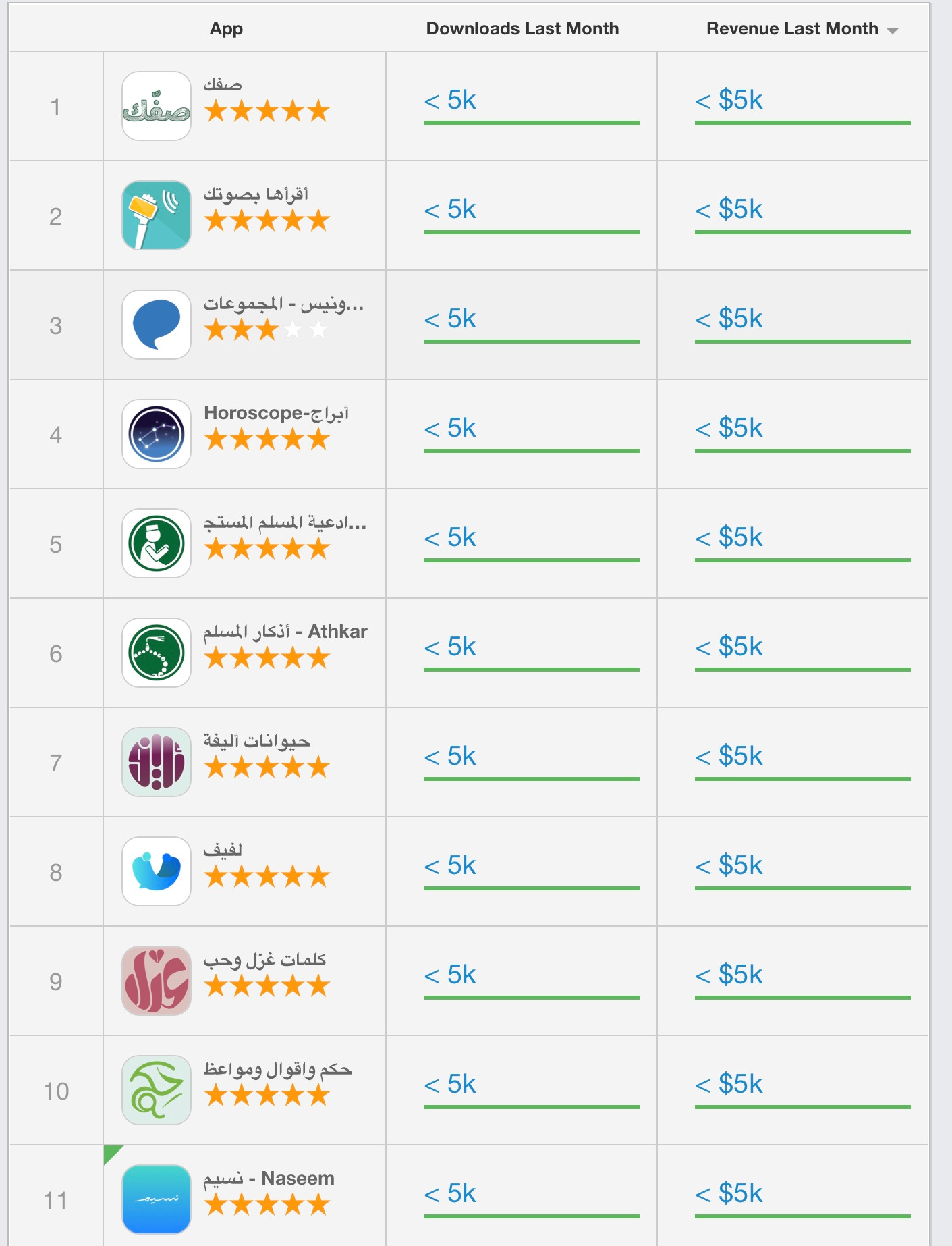

Third, Mawdoo3 then decided to create as many apps and enter into as many different businesses as it could (as shown via acquisitions of ShopGo, Relevant Network7 etc.). It has a growing portfolio but is it sustainable? Are any of its subsidiaries making any money?

The Ugly

Just like SWVL, it seems Mawdoo3 is highly valued. In 2018 it made only $289k in revenues and yet one year later it attracts investment of up to $23.5 million.8

It also raises many questions: who are the investors in Mawdoo3, Kingway Capital (the same investment firm that recently acquired the Tobacco company listed on the Amman Stock Exchange)? Why did Mawdoo3 move to that particular building on the 7th circle?

What is Mawdoo3’s strategy? Is it simply using investor’s funds and gambling it into any new website, platform and see if any of them stick?

Source: Sensor Tower

Just like in every country, some startups are successful, some fail and some are shown to be just outright fraud (fraud: to make outrageous claims with the malicious intent to deceit and to report fake numbers). I personally think that there is no fraud going on but just overhyped companies receiving too much cash when they can achieve little.

Let’s hope Mawdoo3 has a trick up their sleeves in becoming Jordan’s next Unicorn and does not end up in the graveyard of startup failures:

https://www.theverge.com/2017/12/21/16805598/companies-blockchain-tech-cryptocurrency-tea

https://mawdoo3.com/About_Us

https://jo.linkedin.com/in/mubideen/ar

https://blogs.worldbank.org/arabvoices/jordans-education-response-covid-19-speed-support-and-sustainability

https://blogs.worldbank.org/arabvoices/jordans-education-response-covid-19-speed-support-and-sustainability

https://www.menabytes.com/mawdoo3-23-5-million/