While trying to fall asleep, I thought I'd put on something calm in the background to help me drift off. You know, something soothing.

So, naturally, I ended up watching a political debate on Al Mamlaka TV, hosted by Al-Rjob.

On the panel: Rula Al-Hroob, pitching the idea to turn Jordan into Singapore by turning the whole country into a giant tax-free economic zone, like Aqaba.

So, of course, my brain got buzzing and …

Primer

-Sales tax is a “commission” to the government on every transaction in the economy, starting from the production stage, through distribution, and finally to the consumer. The tax rate depends on the type of goods and services, as well as the end user. Here's another one of my AI-voiced videos:

As the video shows, after every stage, the amount of sales tax is reduced and will always be smaller than the amount from the initial stage. That’s why I like to call it Zeno’s Dichotomy Tax.

-It’s been repeated many times that a good chunk of Jordan’s economy belongs in the dark zone: it’s the informal economy1 where workers are not registered with the Social Security (and why our unemployment numbers are incorrect), and nearly no one pays the correct tax be it sales, income, registration, licenses etc. That is one of the reasons the Tax department wants to implement the e-invoicing system (Fotara): to shed light and uncover that part of the unregulated economy2 ; then conquer it and extract the correct amount of sales tax. The second reason for the e-invoicing system is of course to monitor and ensure the sales tax difference (output minus input) is calculated correctly and that no one is “cheating” on their tax returns.

Sales Tax

How much does the government collect in sales tax?

Let’s look at the years 2019 and 20203:

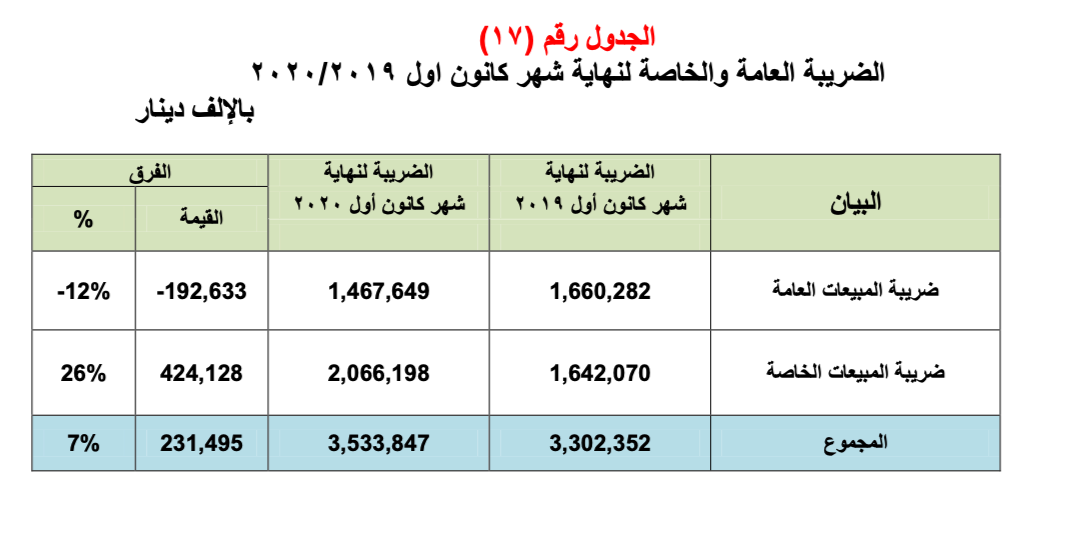

Jordan collected 3.3 billion JODs in sales tax from January to November of 2019 (and 3.5 billion JODs in 2020, +7%). Half of the tax collected was “general sales tax” and the other half was “special sales tax”.

What’s the difference? Well the special sales tax is the excise tax collected only once on certain goods like tobacco, fuel, etc.

Looking into more detail, we notice something even weirder:

For the 2019 period, excise tax from tobacco and petroleum products was 41% of total sales tax collected (52% for 2020)

What’s even stranger for the general sales tax: half of it was sales tax on imported goods. The real sales tax collected by the government largely falls under the 'others' category, which amounts to only 880 million JODs (26% of total). That’s it. The total sales tax is only 12% of domestic revenues or 2.8% of GDP (compared to UK’s VAT contribution of 6.5%4)

Removing Sales Tax

Let’s assume that the government decides to remove the sales tax (but keeps a special tax for imports and all other excise taxes), what would happen next?

Things will immediately get cheaper

Accountants will have more free time

Consumers will have more disposable income

It will be the perfect equaliser: no one will have to pay it, all products will be treated equally, no company receives special treatment due to its location…

Removing the sales tax will actually be beneficial to the economy as it will allow for money to circulate more freely.

What about the missing 880 mil JODs?

I have a few suggestions:

Increase the excise tax on telecoms and internet: there are over 7 million mobile phone subscriptions and more than 800 thousand internet subscribers.5

Add an excise tax on plastic manufacturers (this will also incentivise consumers to reduce waste): part of that collected tax could be used for major clean up efforts.

Keep Fotara e-invoicing system. This is crucial for CBDC and will make it easier to audit for income tax.

But is it worth implementing Fotara under current sales tax laws? No, that extra small amount will not be worth the effort. I wrote about that back in February:

In my opinion, the e-invoicing system will fail at implementation: it’s going to be a big headache for small and medium businesses who will be crushed by the burden of extra work, penalties, and audits. Big business will not be affected and the informal economy won’t be integrated in the economy and will remain outside. Don’t get me wrong, Fotara is a great system. But based on experience and previous policy implementations, it will backfire and hurt the middle class more than intended. If sales tax is cancelled, there will be other uses for it though.

Conclusion

I am not condoning or asking anyone to vote for Roula Al-Hroub and her party but her idea makes perfect sense. We can cancel the sales tax in Jordan and it will be doubly beneficial.

It is important to remember that Sales Tax as we know it today only came about in 1994. It is only 30 years old6. The Hashemite Kingdom didn’t need a sales tax before that. A well implemented excise tax on key products (and services) is more than enough.

Of course no one should base their policy decision on some anonymous Substack post. A focused, serious, and in-depth study should be conducted. And with today’s AI capabilities, we can super-compute multiple scenarios for the economy and get a good idea of what the best outcome could be.

Department of statistics is starting to act on this: https://alrai.com/article/10843081/إقتصاد/الاقتصاد-غير-الرسمي-كشف-النقاب-وتحسين-السياسات

This is not just related to Goods only: Services are included. Next time a plumber or a private teacher comes to your place, try asking for an invoice. They should be paying sales tax on the service they offer (depending on the service).

That’s because the Income and Sales Tax department stopped publishing detailed reports since 2021 : https://www.istd.gov.jo/AR/List/النشرات_الضريبية

How much to add is important here. The government could add 9 JODs/month/subscription and it recoups all of its lost sales tax income. That could be a bit high for some. It is also important to note that not all governorates in Jordan are treated equally when it comes to internet penetration. One idea would be to use part of that collected excise tax to subsidise projects in the rural areas, as is done with the electricity sector. Q1 2024 Report by TRC: https://www.trc.gov.jo/EchoBusV3.0/SystemAssets/سوق%20الاتصالات/7d6eacad-ee67-4eec-998f-5392e84fbfad_Q1%20-2024_15-8.pdf