When a journalist publishes a somewhat negative article, they are usually accused of being a foreign hire with an agenda or exposing the country’s dirty laundry1 to the world.

A real journalist’s job is to display blood-stained laundry.

Nothing is certain except de[bts] and taxes

Benjamin Franklin

(Out of respect to those involved int the following story and to protect their identity, I will try to be as vague as possible to convey the message)

On New Year’s day 2017, at around 1 am, a terror incident occurred that killed 39 people at a night club in Istanbul. 2 of those killed were Jordanians. One of them was a partner of a very successful restaurant in Amman. When that person passed away, their second partner in that famous dining establishment had to take over the day-to-day business. What happened next was a series of unfortunate events that cascaded to the point that the second partner had to leave the country to avoid being thrown in jail for the restaurant’s debts.

The events that took place were the reasons why a lot of businesses were struggling to get their affairs in order. When the first partner tragically passed, there was a long complicated process of inheritance that delayed the second partner’s access to signed cheques to the tax authority. The Tax authority took the decision to freeze all the restaurant’s accounts until the due sales tax amounts were paid (it was customary at the time for the tax department to freeze any amount despite them owing just a fraction). Of course the tax department would then send someone to sit with the cashier and take any amount that comes in (despite most patrons usually preferring paying in credit cards). Then the social security took its move and froze the accounts, not only of the company’s but of the second partner (an L.L.C. will see its shareholders become liable for a company’s liabilities even if not a guarantor—a practice we thankfully seldom see these days). The second partner had to run around between all these governmental departments and negotiate to unfreeze the accounts in order to keep the business running. Both didn’t budge. Suppliers started to hear of the rumours and started demanding cash payments in advance for essential restaurant supplies. Despite some cash injection from one partner, it wasn’t enough to save the sinking boat. There was no proper bankruptcy protection law at the time and the dining establishment shut down. The owner was forced to flee the country to avoid facing jail for the accumulated debts.

This story might be familiar to many in Jordan who are trying to save their businesses. Well known company founders have gone to jail because of mostly outside forces and market downturns outside their control (COVID, Arab Spring, government bureaucracy). Despite establishing big companies and employing thousands, they end up being treated as criminals and thrown to jails alongside drug dealers, murderers, fraudsters, and thieves. One of the issues with the law of imprisoning a debtor who doesn’t pay back is that the law in Jordan made losses somewhat illegal to creditors and didn’t allow for businesses to negotiate a settlement or restructure. A person owed the full amount until the end of times.

Thankfully things have changed by a long mile since then (a lot of the above could only have happened during the BC era/Before COVID):

-In 2018, a bankruptcy protection law was issued (but it was only a few years later that companies started taking advantage of the law and filing for bankruptcy protection like CJC2, and the latest ironic case of micro-lender FINCA3)

-The tax department no longer freezes bank accounts except for the needed amounts.

-COVID saw the biggest push with stopping jails for those indebted under 5,000 JODs as there was a risk of 100,000 people defaulting on their debts. Total prison (or more aptly called Reform and Rehabilitation centres) capacity in Jordan is not more than 25,000. More from this 2021 post:

Shadow (micro) Banking

Korean culture is captivating the world with its music, books and tv shows. The K-pop group BTS recently performed at the United Nations assembly; the Korean film “Parasite” won the Oscar for best foreign film in 2020; and a new hit show called “Squid Game” is breaking world records for Netflix

-And in June of 2025, debtor’s jail will be a thing of the past (for any indebted amount with a few exceptions).

In comparison, imprisonment for debt only ended in 1869 in the United Kingdom with The Debtors Act4

Here is Paul Hijazin from Ro’ya’s Saturday show summarising it:

A test of credit and credibility

Who steals my purse steals trash.

’Tis something, nothing;

’Twas mine, ’tis his, and has been slave to thousands.

But he that filches from me my good name

Robs me of that which not enriches him

And makes me poor indeed.

3.3. 182, Othello, Shakespeare

With the cancellation of prison sentences for debtor’s comes a lot of anxiety for creditors.

A lot of bankers and traders are worried that the threat of jail will remove any guarantee that debtors will ever fulfil their promises to pay back.

One thing most traders relied on were cheques (post-dated). Cheques can be seen as a relic of the past but they are heavily relied on in Jordan. Any person or company that wants to purchase goods or services could get invoiced with a 60 day payment term, but a cheque would be needed on day one. If a cheque bounces, the cheque signatory would end up in jail. And that is the reason why it was the perfect tool for extortion. Debtor’s jail was considered a ‘free money glitch’ in the sense that creditors will never fear the debtor defaulting on their dues.

There is no credibility among traders and businesses which is a big disaster in itself. As I have stated before, the world revolves around trust (trust in latin meaning credo, from where we get credit), not love and/or money.

A famous example of a good trust relationship is this: Sriracha sauce had a verbal agreement with an exclusive pepper farmer from 1988 to 2016. A perfect trustworthy business relationship that sadly ended due to mistrust5.

So what comes next? How will the traders and bankers guarantee they get their money back?

There is already some lobbying to add/keep certain restrictions on those who fail to pay such as placing a travel ban or not allowing them to renew their ID/license until the debts are paid back. Some with a dinosaur mentality want to keep the threat of imprisonment and for the family tribe to bail out those who fail to pay their debts (I am not being critical of tribes or tribal law in Jordan; on the contrary, I think it is an essential edifice of our society. I recommend reading H.R.H Prince Ghazi’s book on the Jordanian tribes6).

So what are the consequences and what could happen starting in July?

-One immediate consequence will be that our correction facilities will be less overcrowded as debtors are freed (will update with the official final numbers). This will be beneficial to the economy in many fronts: the cost alone of feeding one incarcerated citizen is around 1,500 JODs/year7. And once in jail, in the eyes of the government, a jailed debtor becomes a loss in terms of a tax paying citizen, and a productive and consuming economic entity (also a loss of a bread winning family member).

-Another could be the return of Jordanians who run away to other countries to avoid being thrown in jail.

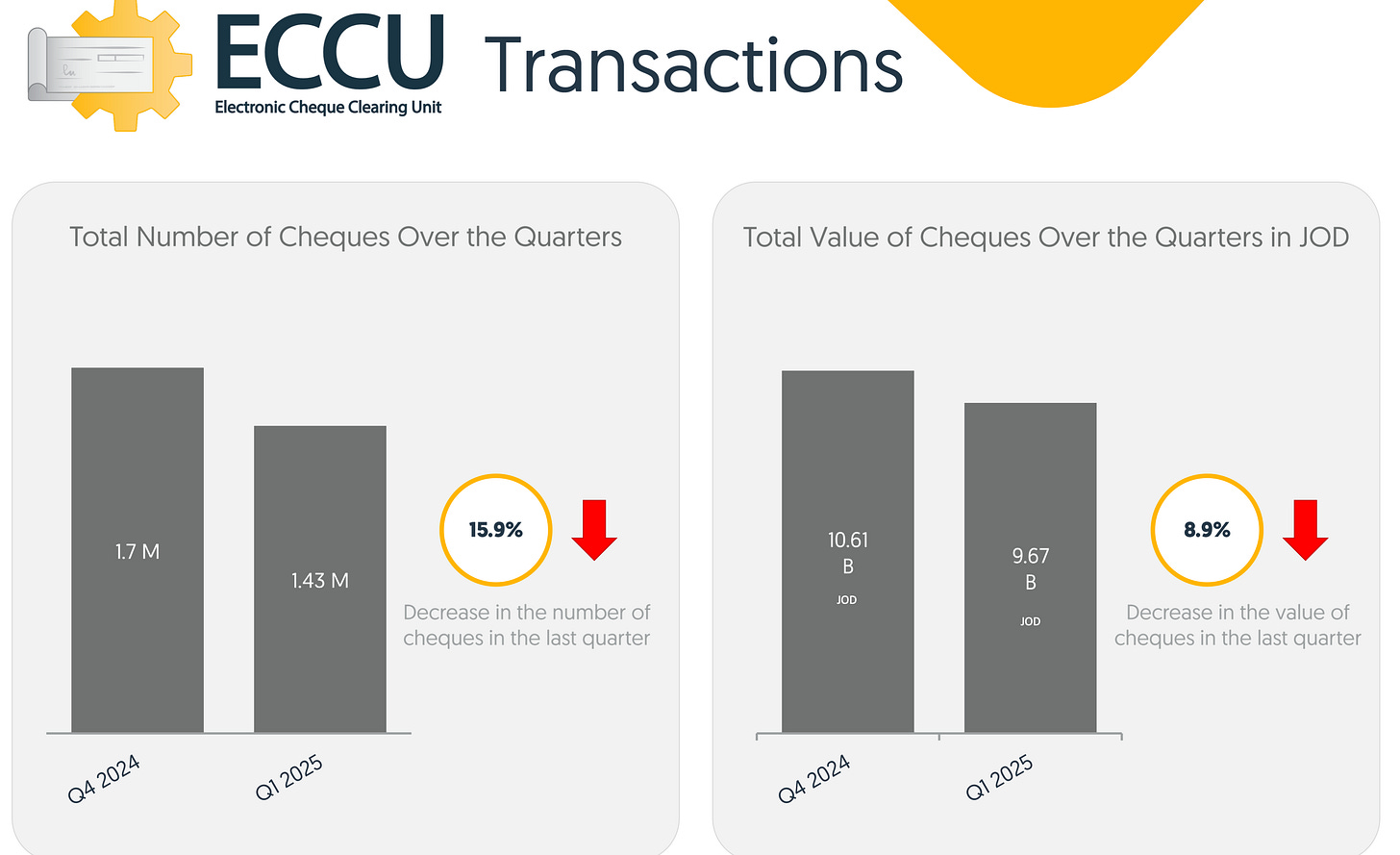

-Another consequence will be the (albeit slow) disappearance of cheques (or archaic promissory notes) from the Jordanian financial system. In Q1 of 2025, cheques have already started to decline dramatically beyond its usual cycle. When a cheque bounces under the new law, the issuer will get a strike and no longer a jail sentence. (3 strikes and they get backlisted from the financial system.)

-Another immediate consequence will be the reinstatement of the risk management departments in banks since there will be an extra risk premium with the abolition of threat of imprisonment for debtors.

-Another positive consequence: traders and suppliers will be relying on the credit rating agency CRIF (under the Jordan Credit Bureau) when dealing with new partners. This would be the turning point that was much needed in our economy.

Trust will be hard to come by at first and we could see some slowing down in the economy. In the beginning, traders will be reluctant to invoice on credit. Slowly but surely, seeing that they are not getting as many customers, the ball will start to roll again. Jordanian businesses are known to adapt quickly and be resilient despite all the headwinds. To avoid a credit crunch8, bankers and traders need to understand that by easing restrictions they will keep the economic wheel greased up. I mean if some of the traders and bankers are still scared, they could still ask for some kind of asset as a guarantee (such as this famous example from China9).

-One consequence could also be the rise of another type of shadow banking: friends and family. This is a form of peer to peer lending that has existed for a long time in our country with little to no guarantee asked by the lenders. A mother would never threaten their child with debtor’s jail. If credit tightens from the banking institutions, it will definitely go up among the bank of family and friends (and we could possibly see the emergence of more smaller credit associations, credit cooperatives, pawnshops, or worse loan sharks)

This is a new chapter in Jordan’s economy that should, in my opinion, give a second chance at recovery. We might see some long term gain despite some short term pain. Yes the beginning will be a bit messy, but once the (over)dues are taken out of the books, we can finally move on.

Example of a journalist always accused of this:

According to latest budget numbers, the cost of feeding around 20,000 incarcerated people is around 30 mil JODs. Link (page 129)